Ct 2024 Tax Rates

Review the latest income tax rates, thresholds and personal allowances in connecticut which are used to calculate salary after tax when factoring in social security. (ii) at the rate of.

Connecticut’s 2024 income tax ranges from 3% to 6.99%. Visit the drs website at portal.ct.gov/drs.

For Tax Year 2024, The 3% Rate For The Lowest Tax Bracket Will Decrease To 2%.

(ii) at the rate of five per cent.

The Rate Cuts Take Effect January 1, 2024.

The connecticut tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in connecticut, the calculator allows you to calculate.

Images References :

Source: melisandrawmommy.pages.dev

Source: melisandrawmommy.pages.dev

Connecticut 2024 Tax Rates Cyb Martina, Connecticut lawmakers approved roughly $460 million in annual tax relief in 2023, including an income tax cut, and changes to pension and annuity deductions. Connecticut's 2024 income tax ranges from 3% to 6.99%.

Source: danitaadrianna.pages.dev

Source: danitaadrianna.pages.dev

Ct Tax Rates 2024 Dorie Geralda, (ii) at the rate of. The 2024 tax rates and thresholds for both the connecticut state tax tables and federal tax tables are comprehensively integrated into the connecticut tax calculator for 2024.

Source: kimberlywadore.pages.dev

Source: kimberlywadore.pages.dev

Ct Tax Changes 2024 Torie Alameda, Income tax relief for the people. Governor lamont announces connecticut income tax rates go down, earned income tax credits go up, senior pension exemptions expand at the start of.

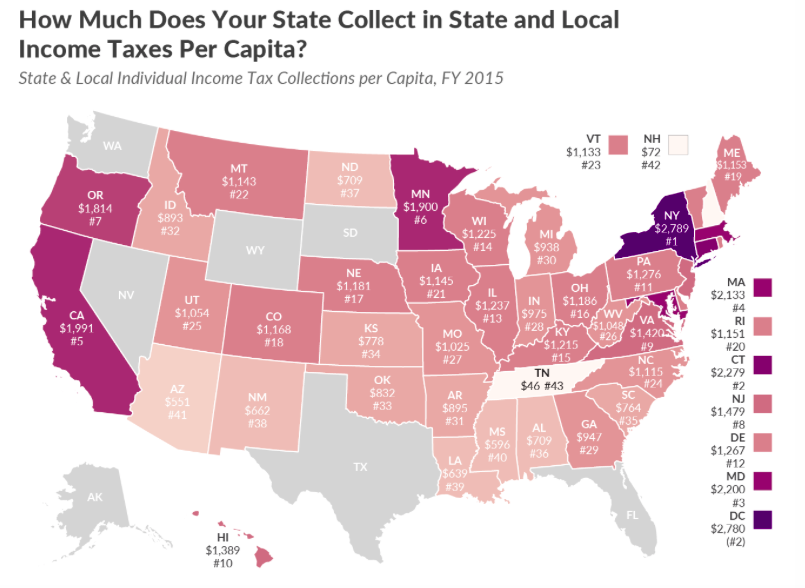

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2024, including reduced income tax rates,. The following are recent legislative changes that impact 2024 withholding requirements for connecticut employers:

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, If you file after march 15,. The 5% rate on the next $40,000 earned by single filers and the next $80,000 by joint filers will drop to 4.5%.

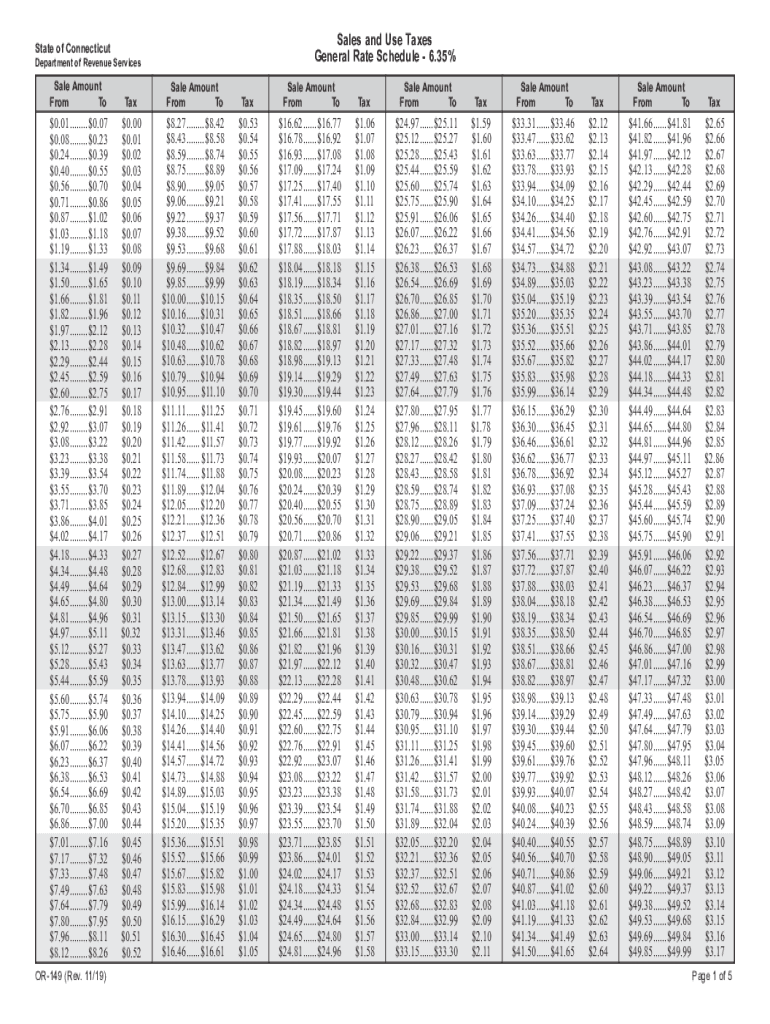

Source: www.signnow.com

Source: www.signnow.com

Ct Sales Tax Chart 20192024 Form Fill Out and Sign Printable PDF, The reduction is estimated to. Connecticut lawmakers approved roughly $460 million in annual tax relief in 2023, including an income tax cut, and changes to pension and annuity deductions.

Source: imagetou.com

Source: imagetou.com

Tax Rates 2024 25 Image to u, (wtnh) — three significant tax relief measures will take effect in connecticut on jan. From 3% to 2% for individuals with.

Source: anetteqphoebe.pages.dev

Source: anetteqphoebe.pages.dev

2024 Tax Brackets Standard Deduction Rafa Rosamund, Calculate your total tax due using the ct tax calculator (update to include the 2024/25 tax brackets). Taxes capital gains as income and the rate reaches a maximum of 9.85%.

Source: sandyewclair.pages.dev

Source: sandyewclair.pages.dev

2024 Tax Brackets And Deductions Mela Stormi, Income tax tables and other tax information is sourced. Welcome to the 2024 income tax calculator for connecticut which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your.

Source: tabbyqlaurice.pages.dev

Source: tabbyqlaurice.pages.dev

2024 Tax Brackets And Standard Deduction Adore Mariska, 1, 2024, reducing taxes for taxpayers by. The rate cuts take effect january 1, 2024.

Meanwhile, The 5% Rate Applied To The Next Bracket Will Fall To 4.5%.

The connecticut tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in connecticut, the calculator allows you to calculate.

Visit The Drs Website At Portal.ct.gov/Drs.

Income tax relief for the people.